Canadian Dollar Gains Ground as Markets Shift Focus

- The Canadian Dollar (CAD) increased on Wednesday

- The rise was influenced by improved broad-market risk appetite

- A bullish reversal in Crude Oil prices contributed to the CAD’s strength

- The CAD’s performance indicates a shift in market sentiment

- The overall market conditions are driving the currency movement

Free!

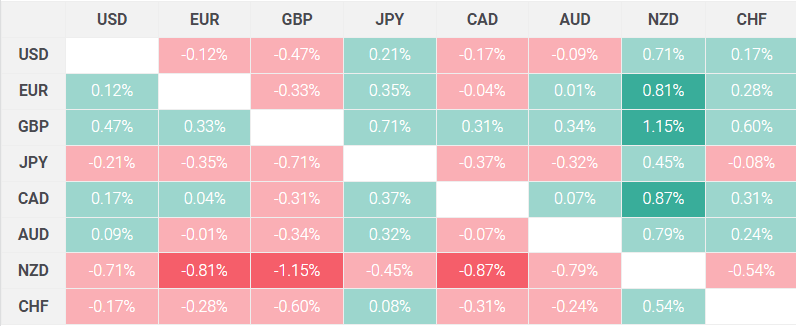

The Canadian Dollar (CAD) showed resilience on Wednesday, gaining momentum as market participants turned their attention toward broader risk appetite and a notable turnaround in Crude Oil prices. This upward movement in CAD signifies a shift in sentiment among investors, reflecting their preferences and strategies in current economic conditions.

Several factors contributed to the Canadian Dollar’s modest gain. Firstly, the overall enhanced risk appetite in global markets has encouraged investors to explore more opportunities beyond traditional safe-haven assets. This broad market optimism, albeit cautious, tends to favor currencies associated with commodities and economic growth—such as the Canadian Dollar.

Moreover, the bullish reversal in Crude Oil prices amplified the CAD’s strength. As Canada is a notable oil exporter, any positive movement in oil prices directly affects the CAD. Investors remained upbeat about crude futures, leading to increased confidence in the currency linked to this vital sector of the Canadian economy.

The interplay between market sentiment and crude oil dynamics illustrates the complex factors driving forex valuation, particularly for commodity-linked currencies like the CAD. Suggestions from analysts indicate that continued upward pressures on oil might provide further support to the Canadian Dollar in the days ahead.

While the uptick in the CAD is encouraging, market participants are also keeping a close eye on macroeconomic indicators and geopolitical factors that could influence currency movements. As trading sessions unfold, the behaviour of risk appetite and crude oil prices will likely remain pivotal in shaping the trajectory of the Canadian Dollar.

In conclusion, as the global markets recalibrate their focus and expectations, the Canadian Dollar’s gradual ascent reinforces its correlation with oil prices and overall market sentiment. Investors will be keenly watching to see if this trend is sustainable in the longer term as they navigate through the complexities of today’s economic landscape.

There are no reviews yet.