Guide to Distinguishing Balance, Equity, and Free Margin

- Explains key concepts in the foreign exchange market: Balance, Equity, and Free Margin

- Defines Balance as the initial account balance of a trader’s account

- Describes Equity as the total value of the trading account, accounting for profits and losses

- Clarifies Free Margin as the available equity that’s not tied up in open trades

- Discusses how Balance, Equity, and Free Margin fluctuate and relate to each other during trading activities

Free!

In the world of foreign exchange trading, understanding foundational concepts is key to successful investment strategies. Among the most important of these concepts are Balance, Equity, and Free Margin. This guide aims to clarify these terms and explain how they relate to one another within the context of trading. For traders, grasping these concepts is essential to effective risk management and overall account performance.

What is Balance?

Balance refers to the initial amount of money that a trader has in their trading account. It represents the account’s monetary state before any trades are opened or closed. In essence, the Balance is the number that shows your current deposits, minus any withdrawals or profits/losses from completed trades. It is a static figure that does not fluctuate as trades are open or close—this value remains constant until the trader makes a withdrawal or deposit or closes a trade.

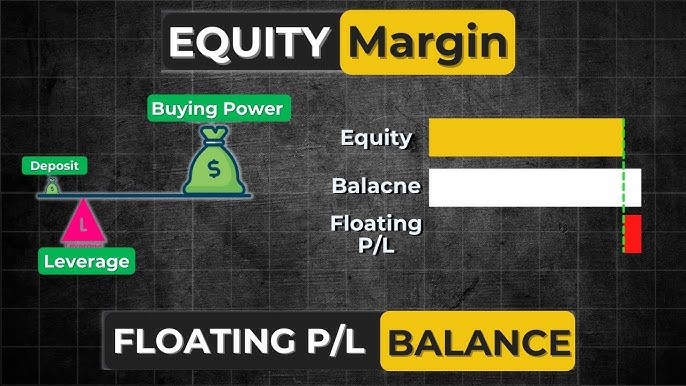

Understanding Equity

Equity goes a step further than Balance. It provides a more comprehensive snapshot of the trading account’s value because it reflects the total worth, including all open trades. Specifically, Equity is the sum of the Balance and the floating profits and losses from your currently open positions. It indicates the actual value of the trading account at any given moment, and as market conditions change, so too will your Equity figure. For traders, monitoring their Equity levels can help highlight trends in account value and influence decision-making regarding whether to open new trades or manage existing ones.

Defining Free Margin

Free Margin is another critical term that traders must understand. This is the amount of available equity in a trading account that is not being used as margin for open positions. In simpler terms, it indicates how much money can be utilized for opening new trades without risking liquidation of ongoing positions. The formula for calculating Free Margin is straightforward: it is derived by subtracting the Margin used (the amount set aside for current trades) from the account’s Equity. A higher Free Margin indicates greater flexibility to enter into new trades, while a lower Free Margin suggests that the account is heavily leveraged and may be at increased risk.

The Interconnection of Balance, Equity, and Free Margin

The three terms interlink closely, creating a dynamic framework for managing an account. Due to the nature of trading, frequent updates to these values occur; as trades are executed and results fluctuate, so too do Balance and Equity. For example, if a trader opens a position that gains profit, their Equity will increase reflecting this gain, while Balance will remain the same until the position is closed. Conversely, if a position incurs a loss, Equity decreases while Balance remains static until that adverse position is closed out. It is also critical to understand that a low Free Margin indicates the account continues to be affected by market movements, increasing the potential risk of mandatory stop-outs or liquidation of positions.

Conclusion

This guide provides a clear understanding of Balance, Equity, and Free Margin and illustrates how these concepts interact within the foreign exchange market. By investing the time to comprehend these terms, traders can enhance their account management skills, effectively manage risk, and ultimately improve their trading outcomes. The concepts correlated closely reflect a trader’s financial status and play a foundational role in decision-making and strategy formulation. Mastering these elements will not only contribute to a sound trading strategy but also foster greater confidence in navigating the complexities of the financial market.

There are no reviews yet.