The Impact of Donald Trump’s Pressure on the USD-Centric Financial System and Associated Risks

- Examines Donald Trump’s influence on the USD-centric financial system

- Despite current dominance, the USD may face challenges due to Trump’s tactics

- Nations may increasingly seek to diversify their financial systems

- Indicates potential long-term risks to the dollar’s status as the world’s reserve currency

- Highlights implications for global economic dynamics

- Suggests a shift in financial strategies among countries could be occurring

Free!

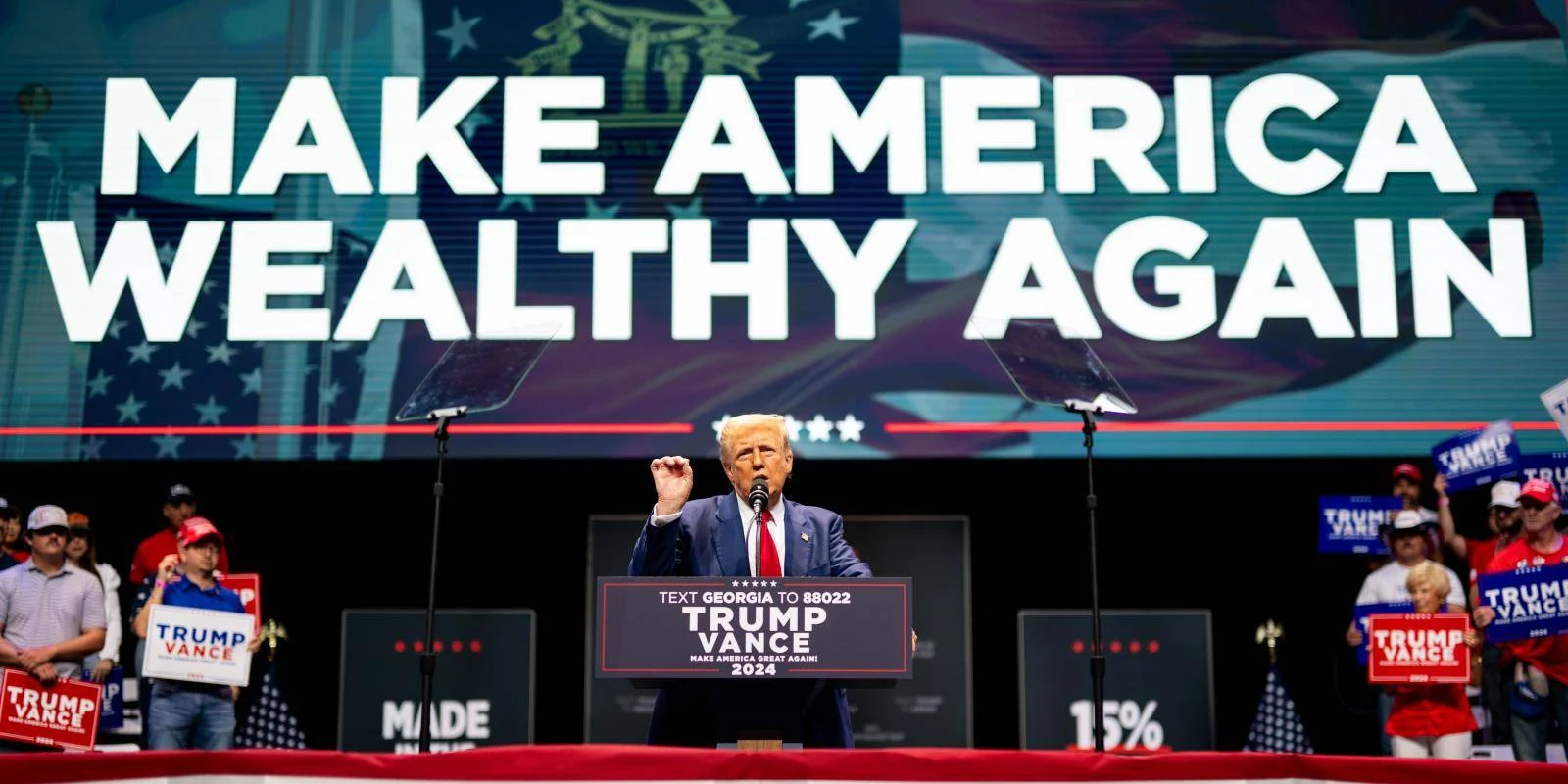

The United States dollar (USD) has long stood as the unquestionable king of global finance—an unparalleled reserve currency dominant in international trade, investment, and monetary policies. However, recent political maneuvers, particularly by former President Donald Trump, have raised critical questions about the future stability of this financial system. As Trump’s approaches unfold, they risk unintentionally prompting other nations to diversify their financial affiliations, potentially posing challenges to the dollar’s supremacy.

Understanding Trump’s Financial Stance

During his presidency, Donald Trump adopted an unusually aggressive stance regarding U.S. monetary policy and trade agreements. His often confrontational and unpredictable behavior in the international arena has led many global players—particularly emerging economies—to reconsider their dependence on the USD. Proposals to sanction countries, manipulations of trade policies, or threats of tariffs have spurred apprehensions about economic retaliation by other nations, prompting them to seek alternatives.

The Move Towards Diversification

The prospect of pegging national economies to the dollar comes with inherent vulnerabilities. Countries such as China and Russia have sensed the opportunity to accelerate their plans for financial independence from the USD. Both nations have explored alternative trading currencies—like the Chinese yuan or the Russian ruble—leading to discussions of bilateral trade agreements that eclipse Kansas currency dependency. This growing sentiment suggests that the cohesive strength of the dollar in international exchange may face considerable strain.

Possible Consequences for the Eurozone and Beyond

In Europe, the Eurozone is well-aware of the potential risks associated with a fluctuating USD-centric financial system. Should a significant number of countries turn towards regional currencies or alternative assets, it may prompt a domino effect that disrupts trade agreements and financial protocols previously built around the dollar. During circumstances of geopolitical tension, the security offered by transacting in a dominant reserve currency is irreplaceable, yet Trump’s policies could unwittingly weaken that advantage.

Risks of Political Backlash and Economic Instability

The volatility introduced by Trump’s pressure on global financial institutions amplifies risk for investors familiar with traditional safe havens. Institutional and individual investors may experience an increase in market unpredictability or face more limitations on foreign investments. The complexity introduced to financial networks could lead to an uncomfortable lag in responding to investment strategies tailored to a USD-based model.

Conclusion: A New Era for Global Finance?

The long-term implications of Donald Trump’s pressure on the USD-driven financial system may challenge the long-held notion of its dominance as the world reserve currency. While impulses to diversify away from the dollar move forward, the inherent risks of instability in the market highlights potential repercussions that could reverberate across the globe. As nations reassess their strategies, both short-term and long-term trading implications could shift, redefining the principles of international finance and calling for close scrutiny about the future of the USD and global monetary system.

There are no reviews yet.