UK Consumer Price Inflation: November 2024 Report

- Title: Consumer Price Inflation in the UK: November 2024

- Focuses on consumer price inflation as a key economic indicator

- Reflects the rate of price increases for goods and services

- Essential for understanding economic health and consumer purchasing power

- Impacts monetary policy decisions and interest rates

- Illustrates trends in economic conditions relevant to consumers and businesses

- Critical for policymakers, economists, and financial analysts

- Published for November 2024, providing timely insights and data

Original price was: $2,024,181,220,241,600.00.$80.00Current price is: $80.00.

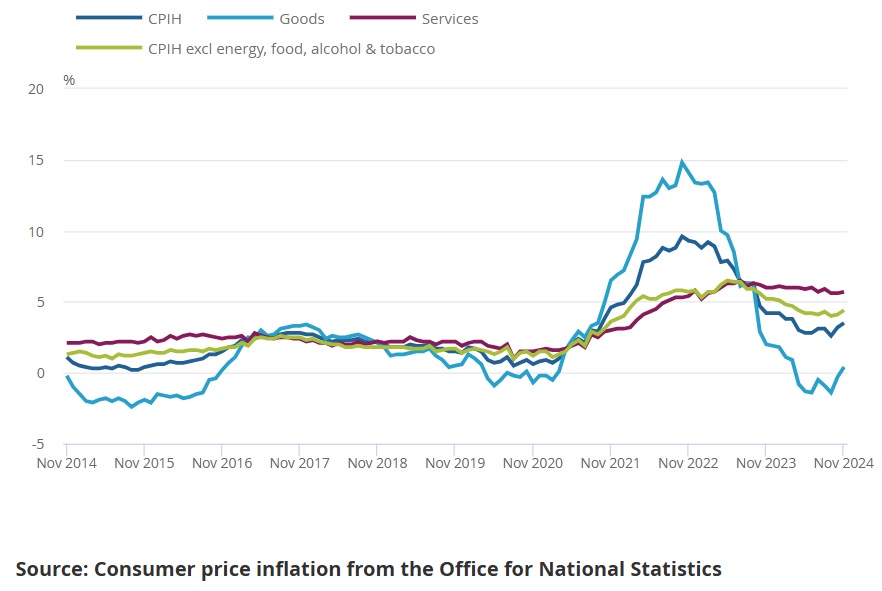

The landscape of consumer price inflation in the United Kingdom has shown notable shifts as of November 2024. Understanding these changes is crucial for businesses, policymakers, and households alike since inflation influences purchasing power, investment decisions, and overall economic health.

Overview of Consumer Price Inflation

At its core, consumer price inflation measures the rate at which the general level of prices for goods and services is rising. Its uptick or decline can indicate economic trends, such as increasing costs of living or changes in consumer demand. The Bank of England closely monitors inflation as part of its mandate to stabilize prices and support the economic stability of the country.

Current Trends in November 2024

As of November 2024, the UK has experienced a moderate rise in consumer price inflation. Analyst reports suggest that inflation stands at an annual rate of 3.2%, a notable change from previous months where the figures were lower. Key factors contributing to this increase include:

- Energy Prices: A resurgence in global energy prices has reverberated through various sectors, impacting everything from household bills to transportation costs.

- Food and Beverage Costs: Supply chain disruptions and climate change effects have further strained food production, leading to increased prices at the grocery store.

- Consumer Demand: Post-pandemic recovery and pent-up consumer demand have fueled spending, adding pressure to an already burdened market.

Sector-Specific Insights

Several sectors are experiencing inflationary pressures differently:

Housing and Utilities

The housing market continues to show resilience, but the costs associated with rents and utility bills have seen an uptick, raising concerns for renters and homeowners alike.

Transport

With the resurgence in energy costs, transport prices have followed suit, impacting commuting costs and the overall price of goods being transported across the country.

Health and Personal Care

The rising costs of medical services and personal care products can also be attributed to inflation this month, forcing consumers to think carefully about their spending habits in this area.

Consumer Response and Adaptation

As inflation affects purchasing habits, consumers are adopting various strategies to cope. Many are prioritizing essential goods, reallocating budgets to absorb rising costs, or seeking alternatives to more expensive products. Retailers also face the challenge of balancing price increases with maintaining customer loyalty.

Conclusion

The November 2024 report emphasizes the complexities of the UK’s economic climate as inflation persists amidst post-pandemic recovery and external pressures. Both consumers and businesses will need to remain vigilant, adapting strategies as necessary to navigate this evolving landscape. Ongoing monitoring of inflation trends remains crucial in informing economic policy and ensuring a balanced approach to managing future price fluctuations.

For further details and monthly updates, stay tuned for our regular reports on consumer price inflation and what it means for the UK economy.

There are no reviews yet.