Alert: US CPI Inflation Decreases to 3% in June, Surpassing Expected 3.1%

- US CPI inflation reduced to 3% in June, lower than the 3.1% expectation

- Yearly inflation decreased from 3.3% in May to 3% in June

- Measurement indicates a decline in consumer price increase rates

- Data reported by the US Bureau of Labor Statistics

- Important indicator for economic health and monetary policy considerations

- Reflects changing economic conditions and consumer spending behavior

- Inflation metrics crucial for forex traders and investors’ strategies

Free!

In a notable economic development, the Consumer Price Index (CPI) inflation in the United States has recorded a significant decline, dropping to 3% in June from 3.3% in May. This unexpected dip has surprised analysts who had projected a more modest decrease to 3.1%.

The US Bureau of Labor Statistics (BLS) reported that this decrease in the annual inflation rate is indicative of a potential shift in the economic landscape, which could have far-reaching implications for consumers and investors alike. A declining CPI suggests that price pressures are easing, offering a glimpse of relief in the midst of rising living costs.

The trend of lowering inflation is likely to influence the decisions of the Federal Reserve in terms of interest rate adjustments in the upcoming months. Many experts believe that these recent figures could provide the Fed with ample reason to reassess its current monetary policy stance aimed at curbing inflation.

This index serves as a crucial gauge for the US economy, helping to track changes in consumer spending and cost of living. With inflation now at its lowest in recent months, the market is poised for potential shifts as investors reevaluate their strategies in response to the latest economic indicators.

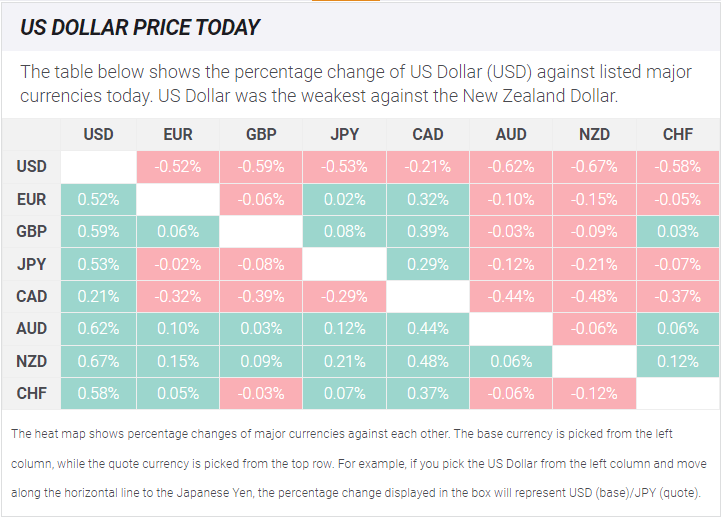

For forex traders, understanding the implications of this CPI drop is essential to exploiting market fluctuations. Forex EAs Mall offers tools and insights that can help traders navigate these changes effectively, positioning them to take advantage of emerging opportunities in the currency markets.

As we keep a close eye on subsequent economic data releases, this CPI decline could serve as a bellwether. Any significant policy changes announced by the Fed in the near future will certainly keep investors and traders on alert.

Stay tuned for more updates and insights from Forex EAs Mall as we continue to monitor the evolving economic situation.

There are no reviews yet.